by Scott Jack

by Scott Jack

Content Contributor, E-N Computers

7+ years experience in healthcare IT and tech support.

Are you thinking about purchasing new equipment for your business? If your business is growing, you may need to add computers, network capacity, and additional server infrastructure. Or if you’re using older equipment and software, it may be time to upgrade to newer versions that you can keep up-to-date and secured. Either way, you want to make these purchases as cost-effective as possible. The Section 179 tax deduction is designed to help with that.

A Section 179 deduction can save you tens of thousands of dollars on equipment purchases. Among other types of equipment, you can use this deduction on IT hardware and software. Combining this deduction with a financing option can even increase its value to you, offering significant savings and increasing your year-end profitability. We’ll dive into each of these aspects, but first, what is Section 179?

QUICK ANSWER:

What is the Section 179 deduction?

Section 179 lets you first-year expense business equipment that you purchase, finance, or lease rather than depreciate over five years. If you are looking to save money on new equipment while reducing your taxable income, this deduction may be useful to you. Combining this deduction with qualified financing can be a powerful way to reduce your equipment costs.

What Is Section 179?

Section 179 is a federal tax deduction that allows businesses to deduct the total cost of new equipment in the year it is placed into service—including machinery, equipment, computers, appliances, and furniture. “Placed into service” means that your equipment is ready and available to be used for its business purpose. For example, computers purchased at the end of 2021 but not ready for use until the beginning of 2022 would be claimed as a Section 179 deduction on your 2022 tax return. For some businesses, this is an attractive alternative to depreciating assets over several years. Here is a brief description from the IRS:

Section 179 is a federal tax deduction that allows businesses to deduct the total cost of new equipment in the year it is placed into service—including machinery, equipment, computers, appliances, and furniture. “Placed into service” means that your equipment is ready and available to be used for its business purpose. For example, computers purchased at the end of 2021 but not ready for use until the beginning of 2022 would be claimed as a Section 179 deduction on your 2022 tax return. For some businesses, this is an attractive alternative to depreciating assets over several years. Here is a brief description from the IRS:

Under Internal Revenue Code section 179, you can expense the acquisition cost of the computer if the computer is qualifying property under section 179, by electing to recover all or part of the cost up to a dollar limit, by deducting the cost in the year you place the computer in service. If there’s any remaining cost, you can either depreciate it with a special depreciation allowance in the year you place the computer in service if the computer is qualified property or you can depreciate any remaining cost over a 5-year recovery period.

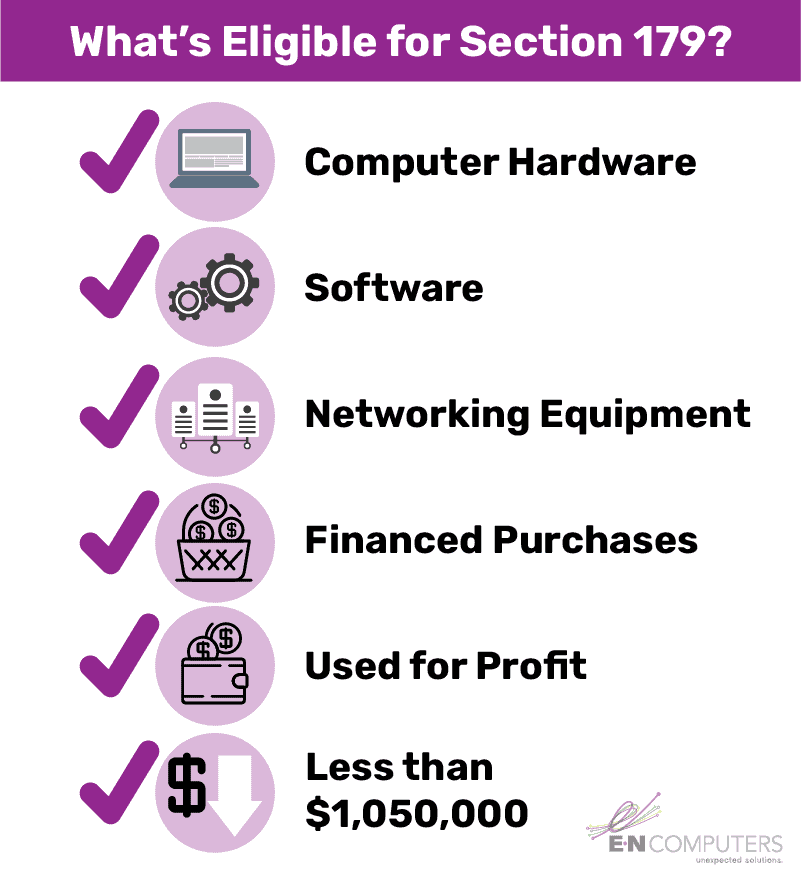

For 2021, the dollar limit for this deduction is $1,050,000. That amount decreases dollar for dollar if your eligible spending exceeds $2,620,000. For remaining costs, Section 168 provides a special, or bonus, depreciation of 100% through 2022. To see how this works, try out the calculator on Section179.org.

You can use the Section 179 deduction to reduce taxable income, but not to have a net operating loss. Losses may be achieved with depreciation methods and special depreciation allowances. Your tax advisor or accountant will be best able to help you determine which approach is most suitable for your business.

Who Can Use This Deduction?

Any US-based for-profit business can take advantage of Section 179. However, the dollar limit and spending cap mentioned above make it especially suitable for small and mid-size businesses. Large businesses that will spend more than $3.6 million on equipment will not benefit from this deduction.

Any US-based for-profit business can take advantage of Section 179. However, the dollar limit and spending cap mentioned above make it especially suitable for small and mid-size businesses. Large businesses that will spend more than $3.6 million on equipment will not benefit from this deduction.

What Is Qualified Equipment?

Section 179 broadly applies to equipment purchased for business used inside the United States. You can use it for all kinds of hardware, including computers, servers, office printers, switches, routers, cabling, and phone systems. You can also use it for software purchases.

Section 179 broadly applies to equipment purchased for business used inside the United States. You can use it for all kinds of hardware, including computers, servers, office printers, switches, routers, cabling, and phone systems. You can also use it for software purchases.

There are a few requirements for software to qualify. It must be off-the-shelf, meaning anyone can buy it. Therefore, you cannot use this deduction for custom applications or those that are heavily modified for your use. Finally, the software must be used for income-producing activities.

There are also some restrictions on how equipment is acquired and used. Property is disqualified if it is:

- used less than 50% for business

- acquired by gift, inheritance, or trade

- acquired from a relative

- held by an estate or trust

- outside the United States

- used by foreign persons or entities

- used by non-profit or government entities

Now that we’ve covered what Section 179 is, who is eligible, and what equipment is covered, one big question remains. Can you finance your equipment purchase, and how is this treated for tax purposes?

Can I Finance These Purchases?

Yes, Section 179 applies to any equipment that you finance, lease, or purchase. When you finance or lease your equipment, you can deduct the full price of the equipment in its first year, before it’s paid off. This can be an enormous boost to your business’s profitability for the year.

Yes, Section 179 applies to any equipment that you finance, lease, or purchase. When you finance or lease your equipment, you can deduct the full price of the equipment in its first year, before it’s paid off. This can be an enormous boost to your business’s profitability for the year.

Here’s how some businesses approach it: They finance equipment toward the end of the year. They place it into service before the end of the year. And then they deduct the full purchase price on their taxes. This approach can generate tax savings larger than your payments for the year. To sweeten the deal, finance companies sometimes offer no payments for the first 90 to 120 days for qualified buyers. That means you can end the year with new equipment, no payments, tax savings, and higher profitability.

The Section 179 deduction is a tax incentive that encourages small businesses to purchase equipment and invest in themselves. To make the right investments and make every dollar count, it’s important to have a logical strategy that identifies your business needs and how your technology stack will help you get there. Do you have the partnerships, strategy, systems, and settings in place that your business needs for stability and growth? Use our quick five-minute IT Self-Assessment to measure your IT maturity and get suggestions on how to improve.

At E-N Computers, we’re focused on being true partners that understand the needs and goals of your business. To that end, our IT managed services emphasize building a comprehensive IT strategy—one that makes sure technology is working for you, not against you. We collaborate with you to plan out equipment purchases so that you get what you need when you need it. We also install, maintain, monitor, and support that equipment so that your staff gets the most out of it. Contact us today to get started!

Next Steps: Learn More About IT Strategy

READ: What is Business/IT Strategy Alignment?

Getting the best value out of your IT purchases requires continual effort to align your IT strategy with your business strategy. To learn more about this process and how we help small businesses practice strategic alignment, read the article What is Business/IT Strategy Alignment?

Take the IT Maturity Assessment

Is your business ready to weather changes, including employee turnover? Find out by taking our IT maturity assessment.

You’ll get personalized action items that you can use to make improvements right away. Plus, you’ll have the opportunity to book a FREE IT strategy session to get even more insights into your IT needs.

Industries

Locations

Waynesboro, VA

Corporate HQ

215 Fifth St.

Waynesboro, VA 22980

Sales: 540-217-6261

Service: 540-885-3129

Accounting: 540-217-6260

Fax: 703-935-2665

Washington D.C.

1126 11th ST. NW

Suite 603

Washington, DC 20001-4366

Sales: 202-888-2770

Service: 866-692-9082

VA DCJS # 11-6604

Locations

Harrisonburg, VA

45 Newman Ave.

Harrisonburg, VA 22801

Sales: 540-569-3465

Service: 866-692-9082

Richmond, VA

3026A W. Cary St.

Richmond, VA 23221

Sales: 804-729-8835

Service: 866-692-9082